If you’ve ever pondered the remarkable journey of a $1,000 investment in Nvidia in 2020, here’s a tale of awe-inspiring growth and what the future holds. Nvidia, listed as NVDA on NASDAQ, witnessed an astonishing surge in share prices, primarily driven by the AI revolution. This article unveils the factors behind Nvidia’s astounding ascent, from gaming to data centers, and forecasts what could lie ahead for this tech giant.

Nvidia (NASDAQ: NVDA) has been one of the hottest stocks on the market this year. Share prices of the semiconductor giant more than tripled in 2023, thanks mainly to the surging interest in artificial intelligence (AI) related stocks.

But what if you’d bought the stock before its AI-fueled rally started?

Let’s say someone bought $1,000 worth of Nvidia shares at the beginning of 2020, well before the AI hype of the past year began. That investor would be sitting on more than 660% price gains, and that $1,000 investment would be worth $7,630. Another way to describe the growth would be to say Nvidia stock has risen more than sevenfold since the beginning of 2020.

Those impressive gains can be attributed to more than just the enthusiasm for anything AI. Let’s look at the growth drivers that have sent this chipmaker soaring since the beginning of the decade and check if they could help this tech stock sustain its future momentum.

The Journey of Nvidia’s Revenue Soars

Nvidia’s revenue has grown at a breathtaking pace from 2020 to 2023. The company reported revenue of $10.9 billion for fiscal 2020 (which ended on Jan. 26, 2020). That figure jumped to an impressive $27 billion in fiscal 2023 (which ended on Jan. 29, 2023).

Nvidia’s annual gaming revenue increased from $5.5 billion in fiscal 2020 to $9 billion during these three years, clocking a compound annual growth rate (CAGR) of almost 18%. However, the gaming business has seen its ups and downs. Sales of gaming graphics cards that power personal computers (PCs) jumped impressively in 2021 and 2022 thanks to the novel coronavirus pandemic.

As people stayed home to avoid spreading the virus, gaming hardware sales, such as graphics cards, surged. Nvidia’s gaming revenue jumped to $7.7 billion in fiscal 2021 and then to $12.5 billion in fiscal 2022. It fell to $9 billion in fiscal 2023 as oversupply struck the PC market and sales of graphics cards plunged.

The Data Center’s Stellar Growth

On the other hand, the data center business has enjoyed outstanding secular growth. Nvidia’s revenue from this segment has surged from just under $3 billion in fiscal 2020 to a record $15 billion in fiscal 2023. The company’s data center revenue in the first six months of fiscal 2024 stands at $14.6 billion, suggesting it could generate significantly higher revenue from this business this year.

What’s worth noting here is that Nvidia is now primarily a data center company, as it generated 76% of its revenue from this segment in the first six months of fiscal 2024. The gaming business produced 18% of overall revenue during the same period. For comparison, gaming accounted for half of Nvidia’s revenue in fiscal 2020, while the data center business was relatively small at 27% of the top line.

But the bottom line is that these two segments remain the heavy lifters for Nvidia. Together, they accounted for a significant chunk of the company’s revenue for the past three years. That’s why it would be a good idea to look at where these segments are headed in the future.

What Lies Ahead for Nvidia’s Key Businesses?

Starting with gaming, the good news for Nvidia is that revenue is again on a growth path. Gaming-related revenue increased 22% yearly in the previous quarter to $2.5 billion. The impressive year-over-year growth resulted from stability in the PC market and a large installed base of Nvidia’s existing graphics card users, who are currently in an upgrade window.

Nvidia CFO Colette Kress believes that gaming GPU demand is back following last year’s slump. Market research firm TechNavio estimates that the gaming GPU market could grow at an annual rate of 16% through the end of 2027, jumping from an annual revenue of $30.5 billion in 2022 to $64 billion in 2027.

Nvidia is in a solid position to make the most of this secular growth opportunity since it controls 80% of the discrete GPU market. Throw in the fact that Nvidia could also win big from the nascent cloud gaming market, where it is currently the dominant player, and it is easy to see that the gaming business is built for growth in the long run.

Similarly, the data center business is sitting on a massive catalyst in the form of AI. We have already seen that the company’s data center revenue shot up remarkably this year, and the trend is expected to persist as the demand for AI servers continues to grow. After all, Nvidia reportedly controls more than 80% of the market for AI chips, which is expected to clock 29% annual growth through 2030 and generate $304 billion in annual revenue at the end of the forecast period. Not surprisingly, Nvidia’s AI-related revenue is expected to jump quickly in the long run.

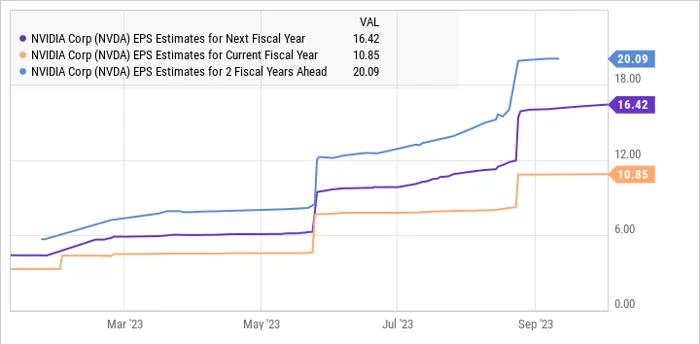

Anticipating Outstanding Growth

As the chart above indicates, Nvidia’s earnings could jump to $20 per share in fiscal 2026. They are multiplying that by the company’s five-year average forward earnings multiple of 41 points toward a stock price of $820 after three years, which would be an 80% jump from current levels. A $1,000 investment in Nvidia right now could be worth $1,800 in three years, so investors looking for a growth stock should consider buying it before it jumps higher.

Investing in Nvidia has been a ride of explosive growth, particularly for early investors. Discover how a $1,000 investment in 2020 could be worth $1,800 today, and delve into the exciting prospects for this tech powerhouse. Nvidia’s ascent, driven by gaming and data centers fueled by the AI revolution, is a testament to the opportunities in the tech sector. Whether considering a new investment or reflecting on past choices, Nvidia’s journey is a captivating strategic growth story.

Note: This article provides insights into the investment potential of Nvidia based on historical data and market analysis. It is not financial advice; potential investors should research and seek advice from financial experts.